Benefit for temporary disability

This is the situation in which a worker finds himself when he is temporarily unable to work and requires medical assistance from Social Security. All affiliated and registered workers can benefit, provided they have made contributions for a minimum of 180 days in the 5 years prior to the date of leave from work begins, when this is due to a common disease. In leave from work is due to an occupational accident or disease, no prior contributions are required.

The eventualities protected are common or work-related illness, including periods of observation for occupational disease (necessary to diagnose the disease) and accidents whether work-related or not.

The benefit is a subsidy calculated on the worker’s contribution base for the month prior to the leave date (regulatory base) by applying the following percentage:

In the event of non-occupational accident or illness, 60% from the fourth day of the sick leave to the twentieth (including both) and 75% from the twenty-first day onwards. In these cases, the business owner pays the benefit to the worker from the fourth to the fifteenth day inclusive.

75% from the day on which the right begins for a work-related accident and occupational disease.

The right to a benefit begins:

on the 4th day of leave in the case of a common disease or non-professional accident.

from the day following the start of leave in the case of a work accident or occupational disease.

The duration of the benefit in the case of an accident or disease, whatever its cause, is 365 days, extendable by a further 180 days when there is reason to assume that during the course of those days the worker’s situation can be cured medically.

Benefit for risk during pregnancy and breastfeeding

This benefit aims to protect the health of the pregnant woman. This covers the eventualities that, due to the working woman having to change to a job more compatible with her condition (because, in accordance with Occupational Risk Prevention Law, the conditions in which she carries out her professional activity can have a negative effect on her health or that of her child), said change does not prove to be technically or objectively possible, or cannot reasonably be expected for justifiable reasons.

The financial benefit for risk during pregnancy is a 100% subsidy of the regulatory base (regulatory base established for temporary disability benefit derived from professional contingencies) for the period necessary to protect the health or safety of the expectant worker, for as long as she is unable to take up her prior position or another position compatible with her condition. In the case of financial benefit for risk during breastfeeding, the subsidy of 100% of the regulatory base will cease as soon as the child is nine months old, unless the beneficiary has already resumed her previous position at work or another position compatible with her condition

Management and payment are the responsibility of the Managing Body or the Social Security’s Mutual Insurance for Occupational Accidents and Diseases, depending on the body with which the company has its occupational risk cover.

Affiliated, registered workers are eligible, with no requirement for a contribution period prior to the date of contract discontinuation or ceased activity due to the mentioned risk.

Maternity benefit

In Spain, women have three basic guaranteed rights when they become mothers: medical care, maternity leave and economic aid. Protected cases include maternity, adoption, custody for the purposes of adoption and fostering, provided the length is less than one year.

Any woman residing in Spain (regardless of her nationality) who lacks sufficient economic resources has the right to free medical care during pregnancy, birth and postpartum, both for herself and for her child.

The lengths of work leave while receiving the benefit are:

For birth, 16 uninterrupted weeks, extendable in the case of multiple birth by two weeks per child from the second onwards; this period can be spread out as desired by the worker, provided that six of these weeks are immediately subsequent to birth.

However, notwithstanding the six weeks immediately post-birth of compulsory time off for the mother, if both parents work, the mother, at the beginning of her maternity leave, may opt to sacrifice a determined, uninterrupted portion of her post-birth leave to the father, whether this be simultaneous with or subsequent to the mother’s leave.

If the working mother does not meet the minimum contributory period requirement, she will receive the non-contributory maternity benefit (100% of IRPEM) for 42 calendar days. This 42-day period can be increased by 14 calendar days when the child is born into a large family, a single-parent family, or in the case of multiple birth, or when the mother or the child are affected by a disability of a level greater than or equal to 65%.

When children under six years of age are adopted or fostered, the duration of the benefit will be 16 weeks, extendable in the case of multiple adoption or fostering by two more weeks per child from the second onwards. The benefit will also last for 16 weeks when the children over 6 years old are disabled or, for personal circumstances or experiences or due to having moved from overseas, they have special difficulties integrating social or into the family. These motives must be duly certified by the relevant social services.

In the case of a disabled child – whether born, adopted or fostered – the maternity benefit will be extended by two weeks.

The option exists for the maternity, adoption or fostering leave to be taken part-time, which makes the benefit compatible with an occupational activity without changing the contract type (in the case of birth, the mother will not be able to use this option during the first six weeks subsequent to the birth, which will entail compulsory rest).

The minimum contribution period required varies according to the worker’s age:

If the worker is under 21 years old at the date of birth, the administrative or legal fostering decision or the resolution authorising adoption, no minimum contribution period will be required.

If the worker is over 21 and under 26 years old at the date of birth, the administrative or legal fostering decision or the resolution authorising adoption, no minimum contribution period will be required, the minimum contribution period required will be 90 days of contributions during the seven years immediately preceding leave. Alternatively, this criterion will be considered to be met if the worker proves having paid contributions for 180 days over his/her working life prior to this date.

If the worker is over 26 years old at the date of birth, the administrative or legal fostering decision or the resolution authorising adoption, no minimum contribution period will be required, the minimum contribution period required will be 180 days of contributions during the seven years immediately preceding leave. Alternatively, this criterion will be considered to be met if the worker proves having paid contributions for 360 days over his/her working life prior to this date.

As regards economic rights, a benefit will be paid by the INSS (National Social Security Institute) directly to the beneficiaries, equal to 100% of the regulatory base (the regulatory base is the contribution base for the month prior to the start of leave).

Paternity benefit

On the birth, adoption or fostering (provided the length is less than one year) of a child, workers are entitled to a period of leave. During that leave, workers of either gender that are affiliated and registered in the Social Security System, up-to-date with contributions and who can provide evidence of a period of at least 180 days as contributors over the seven years immediately prior to the starting date of paternity leave, or alternatively 360 days during the course of their working lives before that date, are eligible to receive the paternity benefit.

The paternity benefit consists of 100% of the regulatory base (or contribution base from the month prior to taking paternity leave) and is paid directly by the INSS to recipients for an uninterrupted period of 4 weeks, extendable by two days for each additional child after the second in the cases of multiple birth, adoption, custody for the purposes of adoption or fostering.

In the case of birth, the benefit is exclusively for the other parent. In the cases of adoption, custody for the purposes of adoption or fostering, it will be available for only one of the parents, at the choice of those concerned. However, when the maternity benefit is taken entirely by one parent, the right to paternity benefit will be available only to the other.

The option exists for paternity leave to be taken full-time or part-time at a minimum of 50% by agreement between the business owner and the worker

In addition, the worker will be entitled to the benefit during the period from the end of the leave awarded for the birth of a child until the end of the maternity leave, or immediately after the end of this leave, provided that, in all cases, the leave is actually taken in the corresponding rest period.

Benefit for looking after minors affected by cancer or other serious diseases

One of the biological, adoptive or foster parents is eligible for a financial benefit to care for the minor/s under his or her care suffering from cancer or any other serious illness if they reduce their working week by at least 50% in order to care directly, continuously and permanently for the minor during the time the latter is in hospital and the illness is being treated. Beneficiaries must be affiliated and registered in a Social Security scheme and have completed the required minimum contribution periods according to their age. The financial benefit consists in a subsidy equivalent to 100% of the regulatory base equivalent to that set for the temporary disability benefit, derived from work contingencies and in proportion with the reduction in the working day.

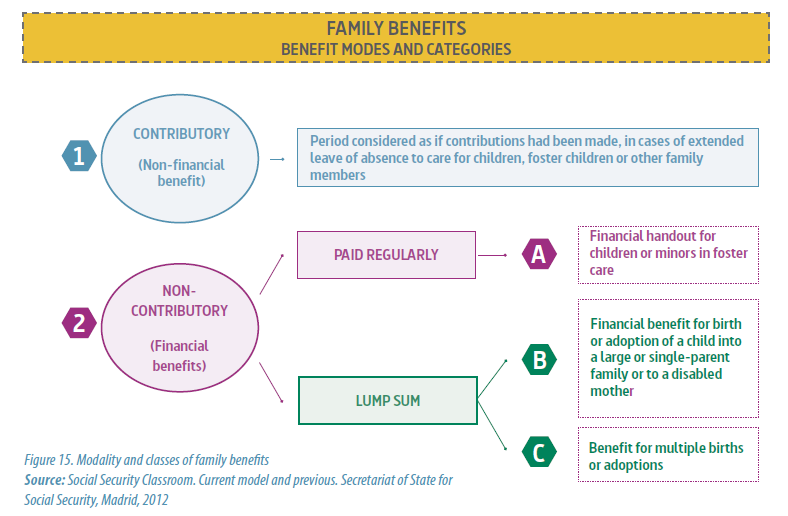

Family benefits

Anyone living on Spanish soil who does not have the right to financial benefits in any other public social protection regime and meets the criteria set out in the regulations is eligible for family protection benefits. Foreign nationals resident in Spain have the right to the same benefits as Spanish nationals.

A. Financial handout for children or minors in foster care

The family benefit is a financial allowance awarded for each dependent child under the age of 18 years, and for dependent children who are in permanent foster care or custody for the purposes of adoption. In this case, annual income must be under the limit fixed annually by the State Budget. Families with children under 18 years old with a disability of at least 33%, or over 18 with disabilities greater than or equal to 65% (irrespective of the family’s level of income) are also eligible. Anyone who is legally resident in Spain is entitled to these benefits, which are requested at the local Social Security Information and Attention Centre.

The amounts of the financial handouts for 2016 are available in the table on the Social Security website:

(http://www.seg-social.es/Internet_1/Trabajadores/PrestacionesPension10935/Prestacionesfamilia10967/index.htm).

B. Financial benefits for the birth or adoption of a child in the case of large families, single-parent families and in the case of mothers with disabilities

This benefit consists in a lump sum payment of €1,000 for large or single-parent families or families with a mother having a disability of at least 65%.

The financial benefits granted for the birth of a child vary according to the number of children, the employment status of the parents and the income of the family unit, and are awarded by various bodies (Social Security, Autonomous Regions, etc.).

There are also benefits for large families throughout Spain, regardless of the Autonomous Region where they reside. These are regulated by the Large Family Protection Act. These benefits include:

Discount on overland transport (RENFE and coach companies), short maritime voyages and plane tickets for national flights.

Social Security contribution bonus for hiring a person to care for children and the household, provided both parents work away from home.

Preferential scoring in public processes regulated by standards (grants and school admission).

Discount or exemption from paying state fees and prices (University entrance exam fees).

Discount on national museum tickets.

Exemption from the payment of fees for the issue or renewal of the national ID card or passport.

Tax deductions.

C. Benefit for multiple births or adoptions

The criteria for receiving the financial benefit for multiple births or adoptions are the same as those for fostered children or minors, except for the income limit, since eligibility is not conditional upon the recipients' income.

The value of the benefit varies according to the number of children born or adopted. Further information on the figures for 2016 can be consulted on Social Security website: (http://www.seg-social.es/Internet_1/Trabajadores/PrestacionesPension10935/Prestacionesfamilia10967/Prestacioneconomica33761/index.htm#40835).

D. Deduction for maternity

Any female worker who has contributed to Social Security receives a benefit from the Agencia Tributaria (Inland Revenue, Ministry of Economic and Financial Affairs) of €100 a month for each child under the age of three. For further details about this benefit, please see the subsection "Mínimos, reducciones y deducciones del IRPF" (Minimum income tax reductions and deductions) (in the section "Ciudadanos" (Citizens)) on the Tax Office website, or call (+34) 901 200 345 or (+34) 91 535 68 13.