If you are looking for a research position

UNEMPLOYMENT BENEFITS

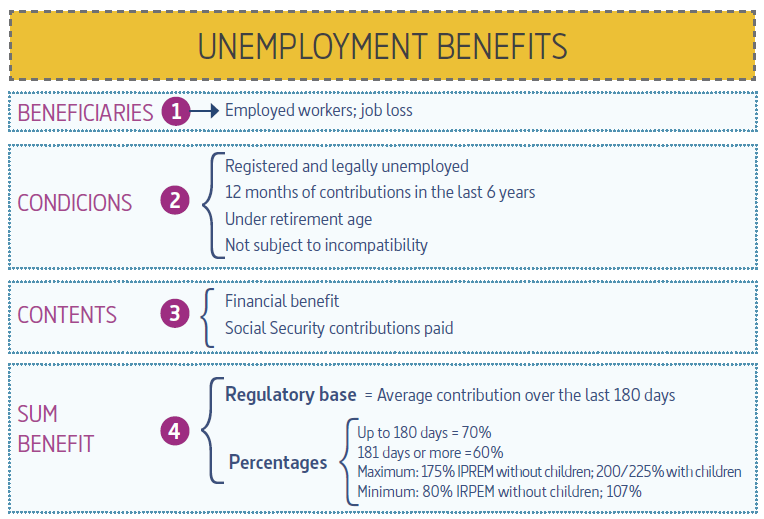

To receive the unemployment benefit in Spain, you must have contributed to Social Security for a minimum of one year (360 days). This contributory period gives you the right to receive benefits for 120 days (4 months). You must also prove that you are actively seeking employment. These benefits can be claimed by going to the Servicio Público de Empleo Estatal (SEPE, Spanish State Employment Service), an autonomous body that currently reports to the Ministry of Employment and Social Security.

For further information, visit their website.

Beneficiaries

The Spanish State Employment Service benefits and subsidies are available to workers from the EU, the EEA (European Economic Area) or Switzerland who reside in Spain. They are also available to workers from other countries who reside and work legally in Spain.

Unemployment benefits.

Source: Social Security Classroom. Current model and previous. Secretariat of State for Social Security, Madrid, 2012

Exporting unemployment benefits

If you are receiving unemployment benefits in any European Union or European Economic Area (EEA) country or Switzerland, you may continue to receive them in any other EEA country (for example, Spain) while you are looking for work here. However, certain requirements must be met:

Such benefits can be received for a maximum of 3 months, except in Portugal, where workers may receive full payment for the entire period they are due.

You must have been registered with the Public Employment service in your country of origin at least one month (4 weeks) before.

You must notify said Public Employment Service of your actual departure date and register with the Spanish State Employment Service within 7 days of departing from your country of origin.

You must bring the completed U2/E303 form with you from your country of origin (the form depends on the country of origin).

Important: the formalities may take up to 2 months, so you should begin the process far enough in advance.

You should also bring the U1/U301 form (depending on country of origin) completed by the Public Employment Service in your country of origin, since if you ever receive the unemployment benefit in Spain, the contribution periods in your country of origin will be taken into account (there is an agreement with Australia which takes into consideration the contributions made there).

The opposite is also true: if you are working in Spain and you end up unemployed, you can complete the reverse formalities to receive unemployment benefits in any other EU/EEA country or Switzerland.

For a list of the public employment services in the EU countries prior to expansion, visit the website.

Amounts received

The amount received as unemployment benefit is established according to the average salary for which you have made contributions (not counting overtime) during the 6 months prior to becoming unemployed. During the first 180 days of unemployment, you will receive 70% of that average and then 50%.

Minimum limit. The amount of the benefit cannot be less than:

80% of the Multiplier for the Public Income Index (IPREM) plus 1/6 (the proportional part of the extra payments), when the worker does not have any dependent children.

107% of the IPREM plus 1/6 (the proportional part of the extra payments), when the worker has at least one dependent child.

Maximum limit. The maximum amount of the benefit is based on the number of dependent children the beneficiary has.

Without children, it is 175% of the IPREM plus 1/6 (the proportional part of the extra payments).

With one child under the age of 26, it is 200 % of the IPREM plus 1/6 (the proportional part of the extra payments).

With two or more children under the age of 26, it is 225 % of the IPREM plus 1/6 (the proportional part of the extra payments).

An amount equivalent to 10 days will be deducted from the first subsidy payment and paid with the final payment. While receiving the benefit, the worker will make Social Security contributions for 100% of the amount of the corresponding payment, which will be deducted from the benefit.

For more detailed information, visit their website at https://www.sepe.es/contenidos/personas/prestaciones/distributiva_prestaciones.html.

Losing unemployment rights

There are several reasons for which unemployment benefit rights may be suspended:

Working for another person or being self-employed while receiving the unemployment subsidy.

Failing to renew the employment request at the Spanish State Employment Service on the established date.

Rejecting a job.

Failure to participate in social collaboration work, employment schemes or professional promotion, training or re-training.

Failure to visit the collaborating employment agencies or to submit the certificate of having visited them.

Further information: Benefit Offices

The Government guarantees social benefits through several entities assigned to the Ministry of Employment and Social Security and the Ministry of Health, Social Services and Equality.

The National Social Security Institute (INSS) is the state managing body responsible for dealing with all Social Security benefits, except non-contributory pensions, unemployment and the Special Plan for sea workers.

Further information by contacting:

National Social Security Institute

C/ Padre Damián, 4 y 6

28036 Madrid (Spain)

Tel.: (+34) 91 568 83 00

The Institute for the Elderly and Social Services (IMSERSO)is the Social Security management body responsible for managing non-contributory pensions and providing social services that complement those provided by the Social Security System in relation to people with disabilities, the elderly, refugees and migrants. All IMSERSO responsibilities have been transferred to the Autonomous Regions, except in the autonomous cities of Ceuta and Melilla.

Further information by contacting:

Instituto de Mayores y Servicios Sociales (IMSERSO)

Avda. Ilustración s/n., con vta. a c/ Ginzo de Limia, 58

28029 Madrid (Spain)

Tel.: (+34) 901 109 899

E-mail: buzon@imserso.es

The Spanish State Employment Service (SEPE) is the Autonomous Body endowed with its own legal authority to fulfil its own duties, attached to the Ministry of Employment and Social Services through the Secretariat of State for Employment. Its main duties include:

Managing and controlling unemployment benefits.

Maintaining databases that guarantee the public registration of offers, demands and contracts, maintaining the occupational monitoring centre and generating statistics on employment at the national level.

Conducting research, studies and analysis on the state of the job market and tools for improving it, in collaboration with the respective Autonomous Regions.

Servicio Público de Empleo Estatal (SEPE)

Calle Condesa de Venadito n.9

28027 Madrid (Spain)

Tel.: (+34) 901 119 999